Hardware

- One lithium 2032 battery included

- APD™ (Automatic Power Down) conserves power

Support

- Three years limited warranty

- Email: studentsupport@numerical-analytics.com

Ideal for

- Finance

- Accounting

- Economics

- Investment

- Statistics

- Marketing

- Real Estate

- Banking

- Sales

- Other business classes

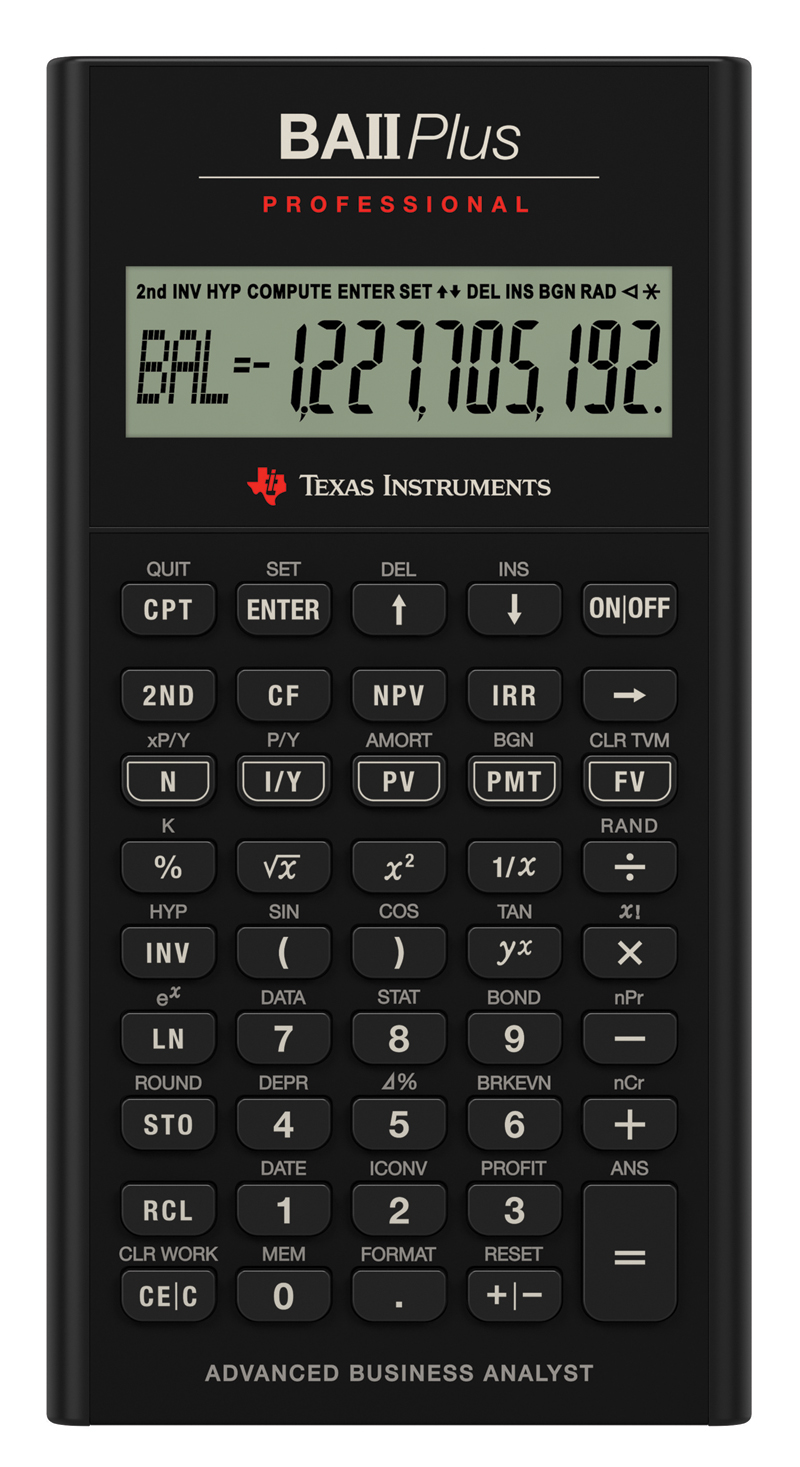

An advanced calculator for business and finance professionals.

Key Features

- Net Feature Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback

- Discount Payback

- Time-Value-of-Money (TVM)

- Accrued Interest

- Amortization

- Cost-Sell-Margin

- Depreciation

- 10-Digit Display

- IRR and NPV for Cash Flow Analysis

- Interest Rates Conversions

- Perform 1 and 2-variable Statistics

- Uneven Cash Flow Storage

- Package includes calculator and protective pouch

Exam acceptance

The BA II Plus™ Professional is approved for use on the following professional exams:

- Chartered Financial Analyst®* exam

- GARP® Financial Risk Manager (FRM®)** exam

Feature highlights

- Calculate IRR, MIRR, NPV and NFV for cash-flow analysis

Store up to 32 uneven cash flows with up to four-digit frequencies and edit inputs to analyze the impact of changes in variables. - Time-value-of-money and amortization

Quickly solve calculations for annuities, loans, mortgages, leases and savings, and easily generate amortization schedules. - Depreciation schedules

Choose from six methods for calculating depreciation, book value and remaining depreciable amount. - Interest rate conversions

Convert between annual (nominal) and effective interest rates. - One-and- two variable statistics

List-based and editable; four regression options: linear, logarithmic, exponential and power.

Built-in functionality

- Solves time-value-of-money calculations such as annuities, mortgages, leases, savings, and more

- Generates amortization schedules

- Performs cash-flow analysis for up to 32 uneven cash flows with up to four-digit frequencies; computes Net Present Value (NPV) and Internal Rate of Return (IRR)

- Net Future Value (NFV)

- Modified Internal Rate of Return (MIRR)

- Modified Duration

- Payback and Discounted Payback

- Choose from two day-count methods (actual/actual or 30/360) to calculate bond price or yield to maturity or to call

- Six methods for calculating depreciation, book value, and remaining depreciable amount: SL, SYD, DB, DB with SL cross-over, SLF and DBF

- Depreciation Schedules

- Bond prices and yield to call or maturity

- Prompted display guides you through financial calculations showing current variable and label

- BGN/END payment setting

- Partial years

- Ten user memories

- Ten-digit display

- List-based one- and two-variable statistics with four regression options: linear, logarithmic, exponential and power

- Math functions include trigonometric calculations, natural logarithms, and powers

Copyright © 2020 | ® Numerical Analytics Instruments Pvt. Ltd | All Rights Reserved.

Copyright © 2020 | ® Numerical Analytics Instruments Pvt. Ltd | All Rights Reserved.